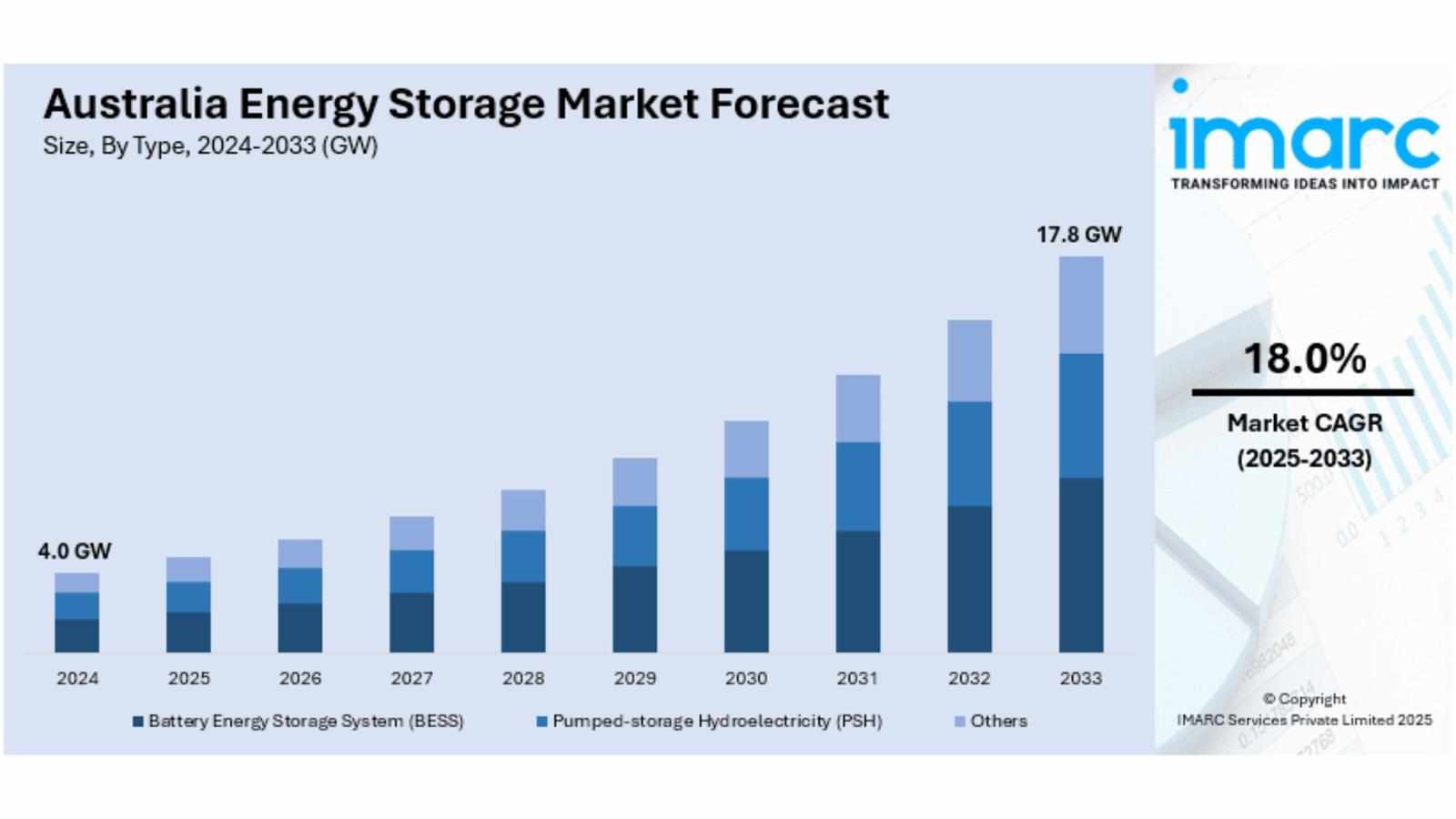

The latest report by IMARC Group, titled "Australia Energy Storage Market Size, Share, Trends and Forecast by Type, End User and Region, 2025-2033," provides an extensive analysis of the Australia energy storage market’s growth. The Australia energy storage market size was valued at 4.0 GW in 2024. Looking forward, IMARC Group expects the market to reach 17.8 GW by 2033, exhibiting a compound annual growth rate (CAGR) of 18.0% during 2025–2033.

Report Attributes:

Base Year: 2024

Forecast Years: 2025–2033

Historical Years: 2019–2024

Market Size in 2024: 4.0 GW

Market Forecast in 2033: 17.8 GW

Market Growth Rate 2025–2033: 18.0%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-energy-storage-market/requestsample

Australia Energy Storage Market Overview

Government is offering a lot of support through incentives and good policies.

The cost of solar panels, wind turbines, and batteries is going down.

Electricity prices are rising quickly, which is making more people and businesses want to use clean energy.

Companies and investors are making big promises to be more eco-friendly and cut down on pollution.

Australia has plenty of natural resources, which helps make big clean energy projects both technically and economically possible.

Key Features and Trends of Australia Energy Storage Market

More homes are using battery storage systems because they are getting cheaper and more people are installing solar panels. Large energy companies are also expanding their battery storage projects, and some of these systems work with both the power grid and renewable energy sources. More customers are using smart tools to manage their energy use and hybrid inverters that work with different types of energy. New technologies like flow batteries, lithium-ion batteries, and long-lasting storage systems are improving how flexible and efficient energy systems can be. Governments and companies are working together to create new ideas and share technology across countries.

Growth Drivers of Australia Energy Storage Market

Rising renewable energy adoption highlights the need for flexible, reliable energy storage.

Government subsidies, regulatory incentives, and strong policy support.

Declining battery costs and rising consumer demand for energy independence.

Rapid electrification, including e-mobility and integration of EV charging infrastructure.

Commercial and industrial uptake to manage peak energy costs and grid instability.

Innovation & Market Demand of Australia Energy Storage Market

Increasing government-backed projects and international collaborations in long-duration storage.

Innovation in hybrid systems combining solar, wind, and storage for continuous power delivery.

Smart energy management and digital tools enhancing user experience and grid flexibility.

Customized business models (e.g., subscription-based EaaS) broadening market access.

Rapid rise in utility-scale projects to balance intermittent renewable generation and ensure supply reliability.

Australia Energy Storage Market Opportunities

Strong growth in residential storage adoption as battery technology costs fall.

Scaling up grid-scale storage for renewable integration, grid balancing, and emergency backup.

Innovations in hybrid and long-duration storage to address intermittency challenges.

Private sector investment and joint ventures accelerating commercialization.

Regional government initiatives fueling expansion in both urban and remote areas.

Australia Energy Storage Market Challenges

High initial capital outlays for new installations and grid upgrades.

Technology and supply chain complexity, especially for advanced long-duration solutions.

Variations in policy regimes and incentive structures between states.

Skills shortages and the need for specialist workforce expansion.

Managing cybersecurity and operational risks in digitalized environments.

Australia Energy Storage Market Analysis

By type: Battery Energy Storage Systems (BESS), pumped-storage hydroelectricity (PSH), and others.

By end user: Residential, commercial and industrial, and utility-scale sectors.

By region: Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

A competitive market landscape driven by technology advancements and major industry players.

Market growth aligns with Australia’s net-zero and renewable targets, transforming energy security and reliability.

Australia Energy Storage Market Segmentation:

By Type:

Battery Energy Storage System (BESS)

Pumped-storage Hydroelectricity (PSH)

Others

By End User:

Residential

Commercial and Industrial

Utility Scale

By Region:

Australian Capital Territory & New South Wales

Victoria & Tasmania

Queensland

Northern Territory & Southern Australia

Western Australia

Australia Energy Storage Market News & Recent Developments:

October 2024: Australia joined the U.S. DOE Long Duration Storage Shot program to cut grid-scale storage costs.

December 2024: CEFC committed USD 50 million for residential battery financing via green lending programs.

Australia Energy Storage Market Key Players:

Tesla Inc.

Enphase Energy Inc.

LG Energy Solution Ltd.

Energy Vault Holdings, Inc.

ACEN Australia

Neoen Australia

Fluence Energy

Key Highlights of the Report:

Market Performance (2019–2024)

Market Outlook (2025–2033)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24686&flag=E

FAQs: Australia Energy Storage Market

Q1: What is the market size of the Australia energy storage market as of 2024?

A: 4.0 GW.

Q2: What is the expected CAGR to 2033?

A: 18.0% from 2025 to 2033.

Q3: What is driving the energy storage market growth?

A: Growth in renewable integration, cost declines, government support, and technology improvement.

Q4: What are key emerging technologies?

A: Advanced lithium-ion, flow battery, long-duration, and hybrid storage systems.

Q5: Who are the top players?

A: Tesla Inc., LG Energy Solution, Enphase Energy, Neoen, and others.

About Us:

IMARC Group is a leading market research company dedicated to providing data-driven insights and expert consulting services to support businesses in achieving their strategic objectives across diverse industries.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Write a comment ...