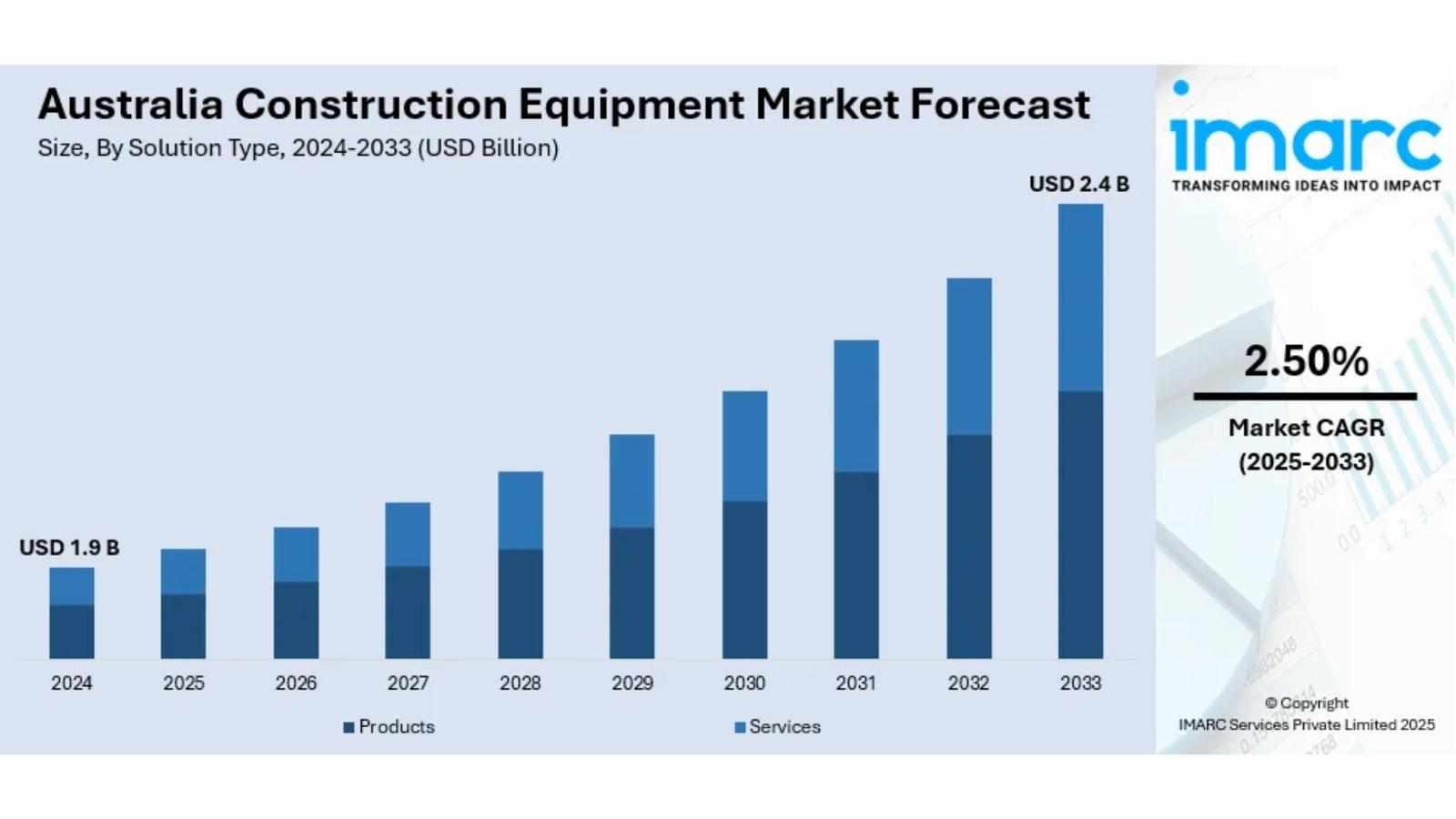

The latest report by IMARC Group, titled “Australia Construction Equipment Market Report by Solution Type (Products, Services), Equipment Type (Heavy Construction Equipment, Compact Construction Equipment), Type (Loader, Cranes, Forklift, Excavator, Dozers, and Others), Application (Excavation and Mining, Lifting and Material Handling, Earth Moving, Transportation, and Others), Industry (Oil and Gas, Construction and Infrastructure, Manufacturing, Mining, and Others), and Region 2025-2033,” offers a comprehensive analysis of the Australia Construction Equipment growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia Construction Equipment market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.4 Billion by 2033, exhibiting a growth rate (CAGR) of 2.50% during 2025–2033.

Report Attributes:

· Base Year: 2024

· Forecast Years: 2025–2033

· Historical Years: 2019–2024

· Market Size in 2024: USD 1.9 Billion

· Market Forecast in 2033: USD 2.4 Billion

· Market Growth Rate 2025–2033: 2.50%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-construction-equipment-market/requestsample

How Is AI Transforming the Construction Equipment Market in Australia?

Facilitating adoption of electric and hybrid construction machinery, reducing emissions.

Enabling real-time asset tracking and telematics improving utilization and maintenance.

Automating construction activities through semi-autonomous and autonomous equipment.

Promoting digital platforms consolidating mixed fleet data for productivity and safety.

Supporting sustainable construction practices with reduced fuel consumption and emissions.

Australia Construction Equipment Market Overview

Witnessing growth driven by booming infrastructure projects and urbanization.

Experiencing increased demand from mining activities requiring heavy machinery.

Benefiting from government investment in national infrastructure and real estate development.

Advancing through incorporation of eco-friendly and technologically advanced machinery.

Supporting expanding commercial and residential construction markets.

Key Features and Trends of Australia Construction Equipment Market

Increasing use of telematics and IoT for machine monitoring and maintenance.

Growing significance of electric and hybrid heavy equipment.

Rise in automation and autonomous machinery testing and deployment.

Expansion of rental services offering flexible equipment access.

Emphasis on sustainability influencing equipment design and fuel choices.

Growth Drivers of Australia Construction Equipment Market

Booming construction and infrastructure development.

Expansion of mining operations requiring advanced machinery.

Government infrastructure investment programs.

Accelerating urbanization and real estate growth.

Rising adoption of eco-friendly machinery and automation.

Innovation & Market Demand of Australia Construction Equipment Market

Implementing automated and autonomous construction equipment solutions.

Developing electric-drive machinery to meet emissions targets.

Integrating digital asset management and analytics platforms.

Upgrading equipment with advanced safety and performance features.

Participating in cross-sector partnerships for sustainable construction.

Australia Construction Equipment Market Opportunities

Growing governmental infrastructure spending expanding equipment demand.

Rising industrial and mining activities requiring specialized machinery.

Increasing demand for rentals and leasing of construction equipment.

Export opportunities to neighboring Asia-Pacific markets.

Expansion of smart and autonomous equipment segments.

Australia Construction Equipment Market Challenges

High initial investment and operating costs.

Supply chain disruptions impacting equipment availability.

Regulatory requirements for emissions and safety compliance.

Skilled labor shortages for operating advanced machinery.

Price volatility in raw materials impacting manufacturing costs.

Australia Construction Equipment Market Analysis

Segmenting by solution type: products and services.

Equipment type segmentation: heavy construction and compact machinery.

Type segmentation including loader, cranes, forklift, excavator, dozers.

Applications covering excavation, lifting, earthmoving, transportation.

Industry coverage including oil and gas, construction, manufacturing, mining.

Australia Construction Equipment Market Segmentation:

1. By Solution Type:

- Products

- Services

2. By Equipment Type:

- Heavy Construction Equipment

- Compact Construction Equipment

3. By Type:

- Loader

- Cranes

- Forklift

- Excavator

- Dozers

- Others

4. By Application:

- Excavation

- Lifting and Material Handling

- Earth Moving

- Transportation

- Others

5. By Industry:

- Oil and Gas

- Construction and Infrastructure

- Manufacturing

- Mining

- Others

6. By Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Construction Equipment Market News & Recent Developments:

Government investment in national infrastructure programs including highways and bridges propelling demand in 2024.

Increased adoption of electric and hybrid machinery for reducing carbon emissions and improving sustainability.

Australia Construction Equipment Market Key Players:

Caterpillar

Komatsu

Liebherr

Volvo Construction Equipment

Hitachi Construction Machinery

JCB

SANY

CNH Industrial

Key Highlights of the Report:

1. Market Performance (2019–2024)

2. Market Outlook (2025–2033)

3. COVID-19 Impact on the Market

4. Porter’s Five Forces Analysis

5. Strategic Recommendations

6. Historical, Current and Future Market Trends

7. Market Drivers and Success Factors

8. SWOT Analysis

9. Structure of the Market

10. Value Chain Analysis

11. Comprehensive Mapping of the Competitive Landscape

[Note:] If you need specific information that is not currently within the scope of the report, IMARC Group can provide it as part of customization.

Ask analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=24741&flag=E

FAQs: Australia Construction Equipment Market

Q1: What is the current size of the Australia Construction Equipment Market?

A1: The market size was USD 1.9 Billion in 2024.

Q2: What is the expected growth rate during 2025–2033?

A2: The market is expected to grow at a CAGR of 2.5%.

Q3: Who are the major players in this market?

A3: Key players include Caterpillar, Komatsu, Liebherr, Volvo Construction Equipment, and Hitachi.

Q4: What are the key growth drivers?

A4: Infrastructure development, mining sector expansion, and government investments.

Q5: Which segments dominate the market?

A5: Heavy construction equipment, especially loaders, excavators, and cranes.

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Write a comment ...