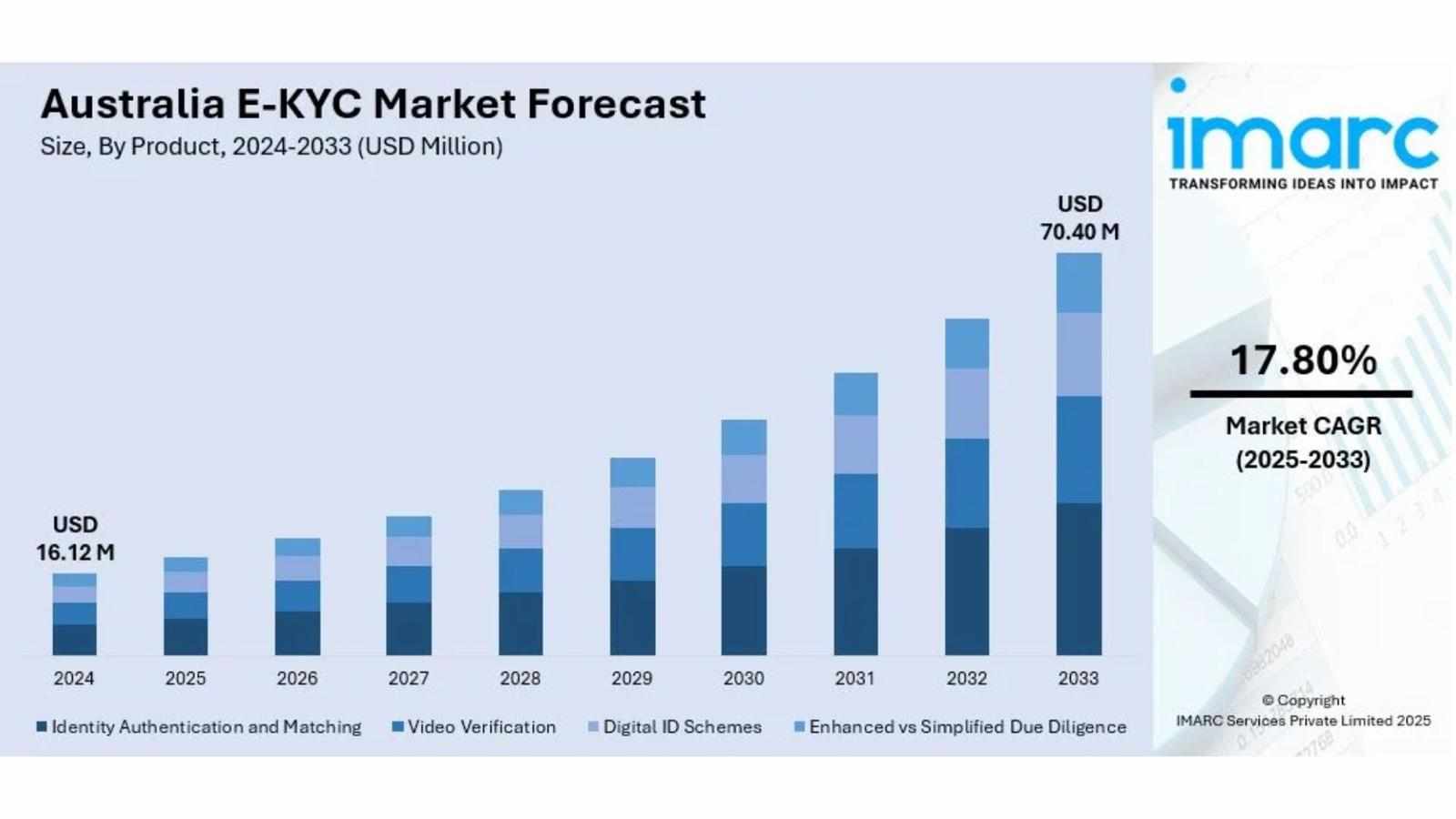

The latest report by IMARC Group, titled “Australia E-KYC Market Size, Share, Trends and Forecast by Product, Deployment Mode, End User, and Region, 2025-2033,” offers a comprehensive analysis of the Australia E-KYC market growth. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Australia E-KYC market size reached USD 16.12 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 70.40 Million by 2033, exhibiting a growth rate (CAGR) of 17.80% during 2025–2033.

Report Attributes:

· Base Year: 2024

· Forecast Years: 2025–2033

· Historical Years: 2019–2024

· Market Size in 2024: USD 16.12 Million

· Market Forecast in 2033: USD 70.40 Million

· Market Growth Rate 2025–2033: 17.80%

For an in-depth analysis, you can refer to a sample copy of the report:

https://www.imarcgroup.com/australia-e-kyc-market/requestsample

Australia E-KYC Market Overview

• More companies are using biometric methods like facial recognition, fingerprint scans, and voice checks in their e-KYC processes. This makes things easier for users and improves safety.

• Cloud-based e-KYC systems are becoming more common. They allow businesses to quickly and easily onboard customers and check identities in real time, regardless of location.

• Companies in banking, insurance, fintech, and telecom are moving quickly to digitize how they sign up new customers. This makes their processes smoother and more efficient.

• Government efforts, such as Australia’s Digital ID Act 2024, are creating a safer and more controlled environment for people to verify their identity online voluntarily.

• The use of e-KYC is spreading to more industries beyond just finance. This helps businesses stand out and generate new ideas.

Key Features and Trends of the Australia E-KYC Market

• After the pandemic, contactless verification methods are now commonly used. They help businesses begin onboarding processes remotely and digitally.

• New developments in AI are making biometric and document checks faster and more accurate.

• Companies are concentrating on following rules about anti-money laundering, counter-terrorism financing, and data privacy by using advanced e-KYC systems.

• Offering a quick and easy identity check improves the customer experience and helps service providers stand out.

• More digital ID systems are being introduced. These systems allow different sectors to share and use verification information easily.

Growth Drivers of the Australia E-KYC Market

• More companies in finance and insurance are moving towards digital transformation.

• The government is supporting digital initiatives with clear rules from the Digital ID Act 2024.

• There is growing worry about cybersecurity, leading to a need for better ways to verify identities and prevent fraud.

• More services are being offered remotely, which requires quick and easy digital sign-up processes.

• New technologies like biometrics and AI are being constantly developed to help with compliance and improve efficiency.

Innovation & Market Demand of Australia E-KYC Market

Providers are using AI to check for fraud and automatically verify users as they happen in real time.

Cloud-based solutions are helping companies connect faster and reduce the work needed to maintain their IT systems.

Businesses are focusing more on making customer experiences smooth, which is leading to more spending on improving website and app designs.

The use of e-KYC is now being used in government services, phone companies, and utility providers when signing people up.

Leading companies are working with digital identity providers to make systems work together better and stay compliant with future rules.

How Is AI Transforming the E-KYC Market in Australia?

AI is making it possible to match biometric data instantly, which saves time and reduces the need for manual work.

Machine learning is used to study verification information, helping to spot patterns and detect any fraudulent activity.

Smart automation is supporting the creation of risk scores that change based on the situation, and it’s helping to manage verification processes more effectively.

AI systems are assisting in following new rules and regulations, and they can provide clear records that are ready for audits.

AI-powered chatbots and support tools are making it easier for customers to get help during the onboarding process.

Australia E-KYC Market Opportunities

The growth of digital identity systems is creating new chances for verification across different industries.

The market is growing in areas like insurance, telecom, and government, which means there are more opportunities to reach customers.

New companies and financial technology firms are using flexible e-KYC tools to speed up when they start operating.

Solutions that support multiple languages and are easier to use for people with different needs are helping more people get involved.

Working together with companies that focus on regulations and cloud services is leading to better innovations in how rules are followed.

Australia E-KYC Market Challenges

High initial investment and integration costs for legacy systems remain a barrier for some organizations.

Ensuring comprehensive data privacy amid expanding data sources and verification channels.

Persistent cybersecurity threats and evolving fraud tactics demand continual innovation.

Fragmentation of digital identity standards could hamper interoperability across platforms.

Ongoing need to educate stakeholders about the security and reliability of e-KYC processes.

Australia E-KYC Market Analysis

Rapid growth in customer onboarding across banks, fintech, and insurance is fueling market expansion.

Regulatory changes, such as the new Digital ID Act, are catalyzing compliant digital transformation.

Market consolidation is likely as established players acquire emerging e-KYC specialists.

Venture capital and partnership activity is accelerating, especially among regtech and cloud verticals.

Regional growth is led by New South Wales, Victoria, and growing uptake in remote and rural Australia.

Australia E-KYC Market Segmentation:

By Product Type:

Identity Authentication and Matching

Video Verification

Digital ID Schemes

Enhanced vs Simplified Due Diligence

By Deployment Mode:

Cloud-Based

On-Premises

By End User:

Banks

Financial Institutions

E-Payment Service Providers

Telecom Companies

Government Entities

Insurance Companies

By Region:

Australia Capital Territory & New South Wales

Victoria & Tasmania

Queensland

Northern Territory & Southern Australia

Western Australia

Australia E-KYC Market News & Recent Developments

December 2024: Australia passes the Digital ID Act 2024, creating a secure, voluntary digital identity system for e-KYC platforms.

February 2025: Leading verification vendor launches a government-compliant ID product to meet surging identity fraud threats.

Australia E-KYC Market Key Players

Leading Australian banks

Regional fintech innovators

Major telecom providers

Specialized regtech solution vendors

Key Highlights of the Report

Market Performance (2019–2024)

Market Outlook (2025–2033)

COVID-19 Impact on the Market

Porter’s Five Forces Analysis

Strategic Recommendations

Historical, Current and Future Market Trends

Market Drivers and Success Factors

SWOT Analysis

Structure of the Market

Value Chain Analysis

Comprehensive Mapping of the Competitive Landscape

Note: If you need specific information that is not currently within the scope of the report, we can provide it to you as a part of the customization.

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=33731&flag=E

FAQs: Australia E-KYC Market

Q1: What is the projected market size of the Australia E-KYC market by 2033?

A: The market is forecast to reach USD 70.40 Million by 2033.

Q2: What are the leading growth drivers for e-KYC adoption in Australia?

A: Key drivers include digital transformation, regulatory requirements, biometric adoption, and advances in AI-powered verification.

Q3: How has regulation impacted the e-KYC landscape?

A: The Digital ID Act 2024 is driving adoption by mandating secure, voluntary digital identity systems and assigning national regulatory authority.

Q4: Which sectors use e-KYC solutions in Australia?

A: E-KYC is widely used in banking, insurance, telecom, e-payment providers, and government services.

Q5: What key technology innovations are shaping the market?

A: AI-powered biometric authentication, cloud-based onboarding, and interoperable digital ID schemes are major technological trends.

About Us:

IMARC Group is a leading market research company that provides management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. Our solutions include comprehensive market intelligence, custom consulting, and actionable insights to help organizations make informed decisions and achieve sustainable growth.

Contact Us:

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-201971-6302

Write a comment ...